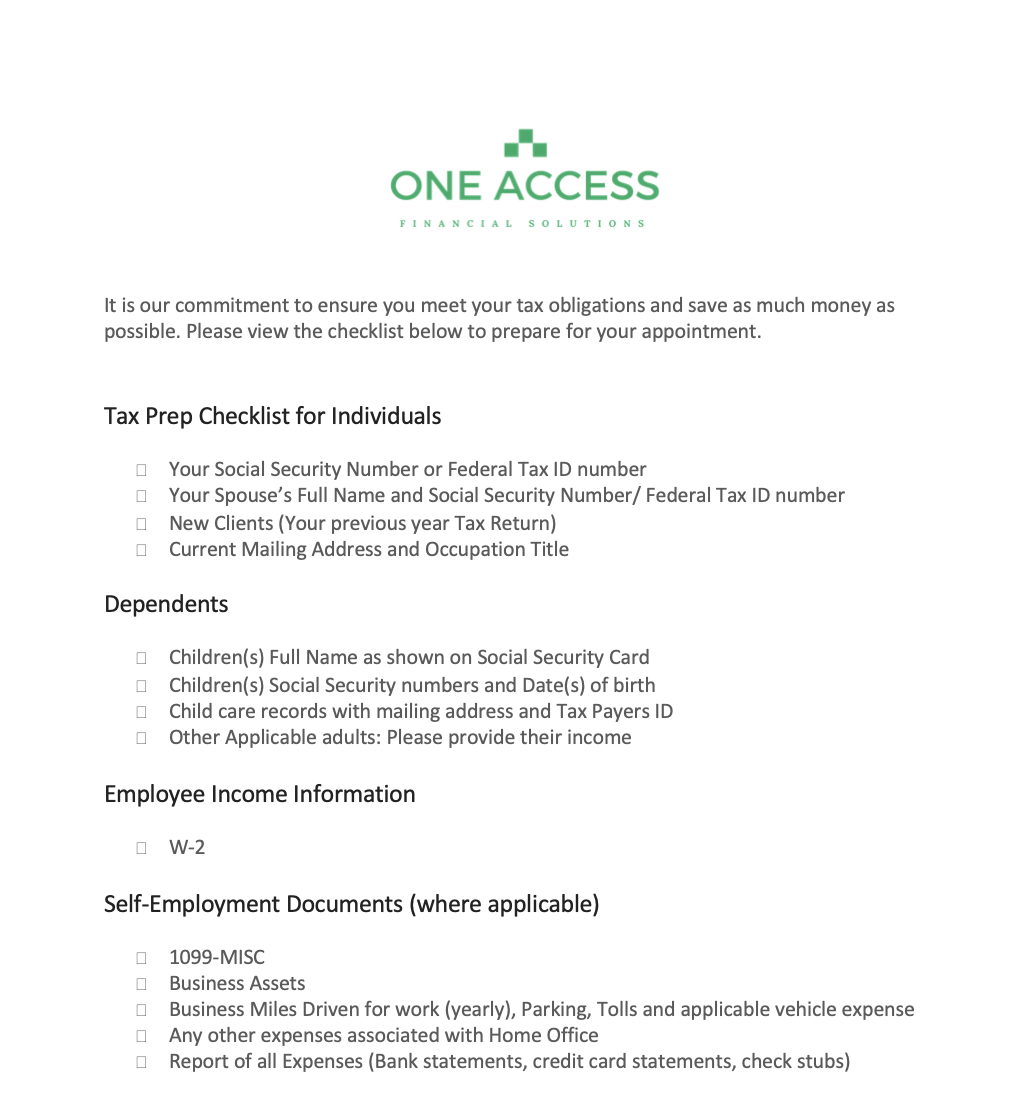

It is our commitment to ensure you meet your tax obligations and save as much money as possible. Please view the checklist below to prepare for your appointment.

Tax Prep Checklist for Individuals

- Your Social Security Number or Federal Tax ID number

- Your Spouse’s Full Name and Social Security Number/ Federal Tax ID number

- New Clients (Your previous year Tax Return)

- Current Mailing Address and Occupation Title

Dependents

- Children(s) Full Name as shown on Social Security Card

- Children(s) Social Security numbers and Date(s) of birth

- Child care records with mailing address and Tax Payers ID

- Other Applicable adults: Please provide their income

Employee Income Information

- W-2

Self-Employment Documents (where applicable)

- 1099-MISC

- Business Assets

- Business Miles Driven for work (yearly), Parking, Tolls and applicable vehicle expense

- Any other expenses associated with Home Office

- Report of all Expenses (Bank statements, credit card statements, check stubs)

Education Information (where applicable)

- 1098-T from colleges (note: Law changes that only “Amounts Paid” is credited not “Amount Billed”)

- Any Educational expenses

- 1098-E for student loan interest paid

Rental Property Information (where applicable)

- Income

- Expenses (Maintenance, Repairs, Decors, Utilities, etc.)

- Property Assets (Hud/ Closing statements)

Retirement, Health Contributions and Contributions to Retirement Plans

- Retirement Income

- 5498-SA HSA contributions

- Pension/ IRA (Form 5498)/ Annuity 1099-R

- Social Security/ RRB Income 1099-SSA/RRB-1099

Investments and Savings

- Interest and dividend income (1099-INT, 1099-OID, 1099-DIV)

- Stock sales and buys(1099-B, 1099-S, 1099-B)

Other Income (where applicable)

- Unemployment, State Refunds (1099-G)

- Gambling Income

- Alimony received

- HSA and long term care (1099-SA, 1099-LTC)

- Jury Duty document of pay

- Other 1099

Affordable Care Act

- 1095-A ( This form is from the Marketplace Exchange)

- 1095-B and 1095-C (If you had insurance through any other source)

- Market Place exemption certificate (ECN)

Other Credits and Deductions

- Moving expense records (not reimbursed)

- 1098 Mortgage interest statements

- If Refinanced, Sold or Purchased a home provided Closing Statement/ HUD1

- State or Local Taxes Paid (Vehicle Property Taxes, Real estate Property taxes)

- Cash/ Checks donations to Church, Schools and other credited charitable organizations

- Documents of non-cash donations and charity

- Healthcare medical expenses, doctors, co-pays, dentist, prescriptions, miles driven

- Employment related expenses (dues, uniforms, cleaning, traveling, tools, telephone)

- Job hunting expenses

- Energy Saving home improvements

- Estimated tax payments