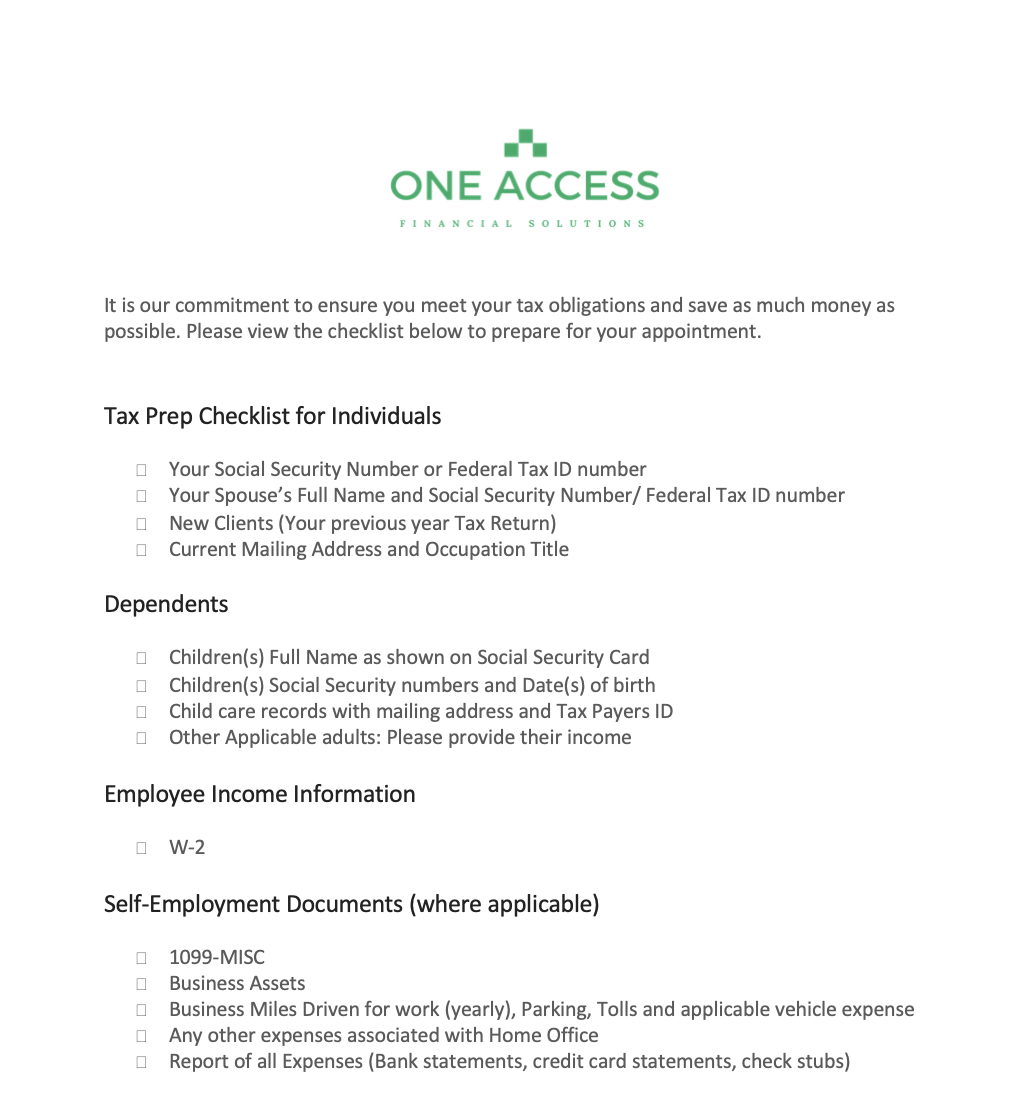

It is our commitment to ensure you meet your tax obligations and save as much money as possible. Please view the checklist below to prepare for your appointment.

Tax Prep Checklist for Business

- Balance Sheets & Profit and Loss Reports

Income

- Gross Income

- Business Banking Interest 1099-INT

- Other Income

Expenses

- Cost of Goods Sold (Inventory & Material and Supplies)

- Advertising, Rent, Phone, travel, Insurance, Office supplies, etc.

- Pay and commissions to Sub-Contractors 1099-MISC or a 1096

- Depreciation Assets (Sale or Buy records)

- Home Office Expenses (square footage of office space and total house square footage, home insurance/rental insurance, utilities, improvements to home office)

- Salaries and Wages to employees (W-3)

- Estimated Tax Payments

- Health Insurance (premiums paid)

- Health Reimbursement program totals

- Vehicle Expenses (mileage, maintenance